how long can you go without paying property taxes in missouri

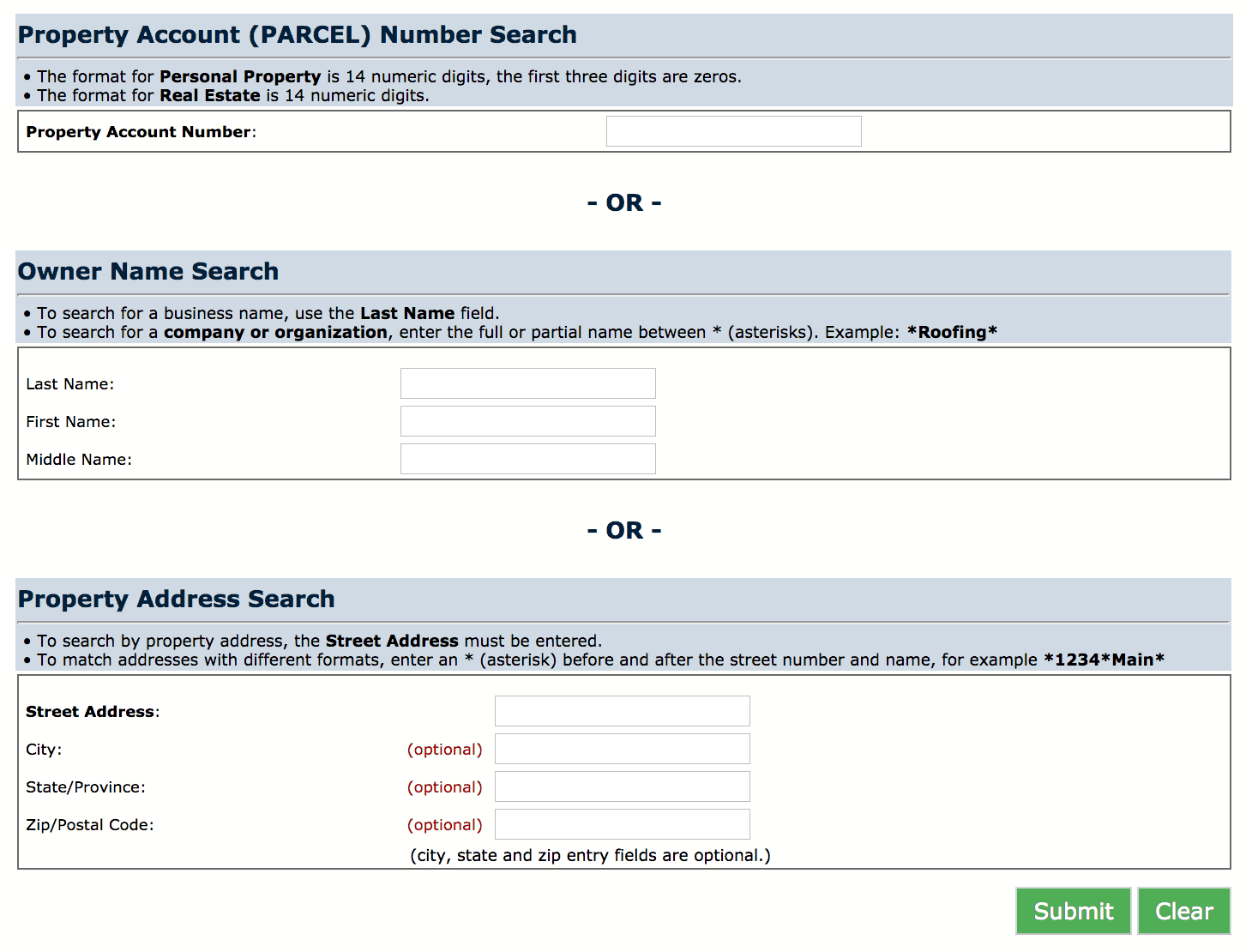

An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft. How long can you go without paying property taxes in Arizona.

Missouri Department Of Revenue Missourirevenue Twitter

Then youd need to pay that inheritance tax.

. How Long Can You Go Without Paying Property Taxes In Missouri. There will be a handling fee of 050 to use this service. If property taxes are two calendar years in arrears the City can register a lien or Tax Arrears Certificate on title as per the Ontario Municipal Act 2001.

ECheck - You will need your routing number and checking or savings account number. If a property is delinquent for 3 years it is placed on a Delinquency List that is sent to the State of New Mexico Property Tax Division in July of each year. How Long Can You Go Without Paying Property Taxes In Missouri.

If you die in Missouri with a valid will then your property and other assets will be distributed according to that will barring a successful will contest. Missouris requirements for a valid will include. In states that sell tax liens there is a specified period of time stated by law in which the original property owner can pay off the lien and prevent full foreclosure.

How Long Can You Go Without Paying Property Taxes In Missouri. In Michigan state law allows any public taxing agency -- state or local -- to claim a lien on property once 35 days have passed after a final bill is sent to the homeowner. The Missouri period usually lasts until a year or more.

Indicate the amount in arrears on the tax bill. According to the Texas Comptrollers Office taxing units are required to give property owners at least 21 days after their original tax bills are mailed to pay the amount due. A tax waiver also known as Statement of Non-Assessment indicates a specific person business or corporation does not owe any personal property taxes for a specified tax year.

What is a personal property tax waiver. Depending on where you live this period may last anywhere from two weeks to several years. Our display at the south door of the Historic Truman Courthouse in Independence has information about our products in addition to our displays in the 12th Street store.

In general Missouri offers one year of protection. One year of compliance is usually enough time for Missouri to apply for federal assistance. Before registering a Lien on Title the City will.

If youd rather not pay through your mortgage company you can pay your taxes on your own. How Long Can You Go Without Paying Property Taxes In Missouri. You can pay your Jackson County property taxes at the west entrance of the Kansas City Courthouse 415 E.

Under Missouri law when you dont pay your property taxes the county collector is permitted to sell your home at a tax sale to pay the overdue taxes interest and other charges. How long can you go without paying property taxes in Wisconsin. How long can you go without paying property taxes in missouri.

140150 140190. As for property taxes the homeowner forfeits the property to the agency in the second year of a tax delinquency. In missouri you can redeem the property.

These taxes are collected by the government and used to support programs such as schools public services libraries roads recreation centers and parks. The duration of this period varies by county but it usually lasts between 10 and 15 days. Home has only been redeemed in ninety days if the residence was sold on the third sale.

You may pay at our office located at 729 Maple Street Hillsboro MO 63050 online at Jefferson County Property Taxes or by Interactive Voice Response by calling 877-690-3729 if paying by IVR you will need to know your bill number and the Jefferson County Jurisdiction code 3515. In Wisconsin most people get a two-year redemption period to pay off all taxes penalties interest and other costs called redeeming the home before the county can start the process to get title to the property. To pay in person the Missouri Department of Revenue accepts online payments such as extended or estimated taxes using credit cards or E-Checks Electronic Bank Drafts.

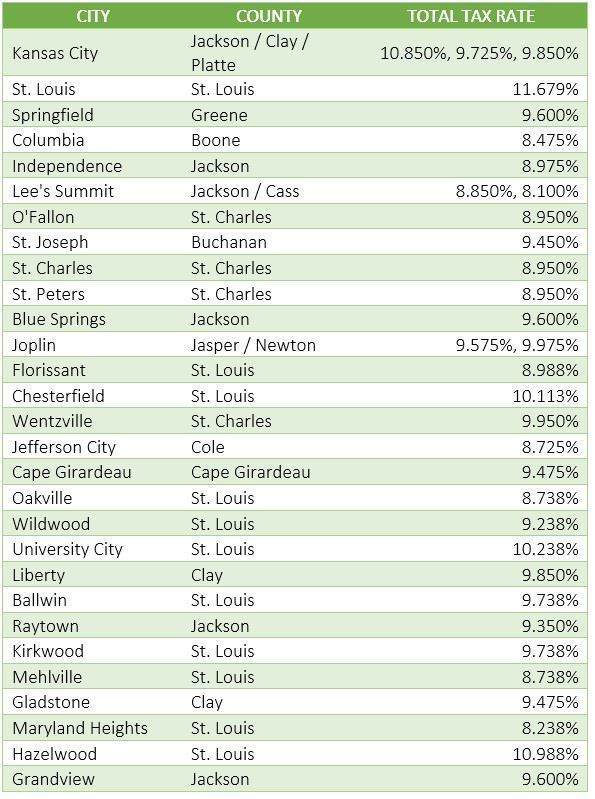

Rates in Missouri vary significantly depending on where you live though. Please allow 3-4 business days for eCheck transactions to apply to your tax account. In the case of real estate ownership taxes are due.

There must be a tax sale within three years although delinquent taxes may be. Some states allow the property tax authority to foreclose on the home directly if taxes go unpaid. There is a wide range of length that may apply to this period.

How long can you go without paying property taxes in New Mexico. It depends on the county how long this is for each period. The Missouri Department of Revenue will eventually sell your home when you are delinquent in paying your property taxes.

If your tax bill is not mailed out until after January 10 your delinquency date will get pushed out. If the taxes remain unpaid after two years the treasurers auction off those liens to investors who then pay the delinquent tax recouping money the. For example if you get a 15000 residential property tax bill and dont pay it by january 31 you.

Can I Pay My Missouri Personal Property Taxes Online. This period of time is known as the redemption period. How long can you go without paying property taxes in Missouri.

Missouri Property Tax Rates The states average effective property tax rate is 093 somewhat lower than the national average of 107. Do you have to pay personal property tax every year in missouri. How long can you go without paying property taxes in Ontario.

In Missouri a tax sale will typically take place if you dont pay the property taxes on your home for three years. According to state law in Missouri counties are allowed to sell homes when no longer able to collect taxes due on your property interest and other expenses. The testator must be at least 18 years old and of sound mind the will must be signed by the testator and at least two witnesses it must be written with a few exceptions.

A tax sale must happen within three years though state law permits an earlier sale if the taxes are delinquent. When a property owner falls behind on paying taxes county treasurers place liens on properties with delinquent property taxes. Missouri traditionally has a one-year rape pendency period.

Missouri Sales Tax Guide For Businesses

Missouri Property Tax H R Block

Missouri Income Tax Rate And Brackets H R Block

Missouri State Taxes For 2022 Tax Season Forbes Advisor

Personal Property Tax Jackson County Mo

Pin On Politics In The Early 1900s

Sales Use Tax Credit Inquiry Instructions

Faq Categories Personal Property Tax Clay County Missouri Tax

Missouri Mo State Tax Refund Status And Tax Brackets Taxact

How To Use The Property Tax Portal Clay County Missouri Tax

Fill Free Fillable Forms For The State Of Missouri

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax States

Find Homes For Sale Market Statistics Foreclosures Property Taxes Real Estate News Agent Reviews Condos Find Homes For Sale Real Estate News Property Tax

Missouri Estate Tax Everything You Need To Know Smartasset

Missouri Sales Tax Small Business Guide Truic